Pros of Debt Consolidation

One of the shining beacons of debt consolidation is the promise of lower interest rates. By combining multiple debts into one, you may qualify for a lower overall interest rate, reducing the amount of money you have to pay over time. Additionally, consolidating your debts can simplify your repayment process, merging multiple payments into a single, manageable monthly installment.

Cons of Debt Consolidation

However, like any financial decision, debt consolidation comes with its own set of risks. While you may secure a lower interest rate on your consolidated loan, there’s a possibility that you could end up paying more in total interest over the life of the loan. Moreover, some consolidation methods, such as home equity loans, require you to put your home up as collateral, risking foreclosure if you default on payments.

Types of Debt Consolidation

Debt consolidation can take various forms, including personal loans, balance transfer credit cards, and home equity loans. Each method has its own set of pros and cons, so it’s crucial to weigh your options carefully before proceeding.

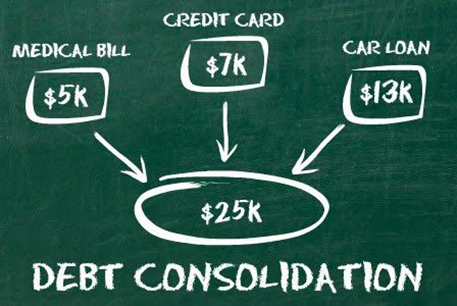

How Does Debt Consolidation Work?

Before diving headfirst into https://freeport-real-estate.com/, it’s essential to understand how the process works. Start by assessing your debt – calculate the total amount owed, interest rates, and monthly payments. Then, research the different consolidation options available and choose the one that best fits your financial situation. Finally, apply for consolidation and await approval from the lender.

Factors to Consider

Several factors can influence the success of your debt consolidation journey, including your credit score, the interest rates offered by lenders, and any fees and charges associated with the consolidation process. Be sure to consider these factors carefully before making a decision.

Alternatives to Debt Consolidation

Debt consolidation isn’t the only option for managing debt. Debt management plans, debt settlement, and bankruptcy are alternative strategies that may better suit your needs depending on your financial circumstances.

The Impact on Credit Score

One concern many people have about debt consolidation is its potential impact on their credit score. While consolidating debt can initially lower your score, making timely payments on your consolidated loan can ultimately improve your creditworthiness over time.

Case Studies

To illustrate the real-world implications of debt consolidation, let’s delve into some case studies. These success stories and cautionary tales provide valuable insights into the benefits and pitfalls of debt consolidation.

Tips for Successful Debt Consolidation

To maximize the effectiveness of debt consolidation, consider implementing budgeting techniques, avoiding new debt, and seeking professional advice when needed. These tips can help ensure a smooth consolidation process and set you on the path to financial freedom.

Common Misconceptions

Despite its benefits, debt consolidation is not without its fair share of misconceptions. It’s essential to debunk myths such as the belief that debt consolidation erases debt entirely or that it’s only for those in dire financial straits.

Personal Finance Management Tips

In addition to debt consolidation, adopting sound personal finance management practices is crucial for long-term financial health. Building emergency funds and creating a repayment strategy can help prevent future financial crises.

How to Avoid Getting into Debt Again

Lastly, it’s essential to learn from past mistakes and take proactive steps to avoid falling back into debt. By improving your financial literacy and making necessary lifestyle adjustments, you can steer clear of financial pitfalls in the future.

Conclusion

In conclusion, debt consolidation can be a viable solution for managing overwhelming debt, offering benefits such as lower interest rates and simplified repayment. However, it’s essential to weigh the pros and cons carefully and consider alternative options before proceeding. With careful planning, budgeting, and a commitment to financial responsibility, debt consolidation can pave the way to a brighter financial future.